The Toronto Regional Real Estate Board recently published its market report for December 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

Essential Analytics - January 2026

The Toronto Regional Real Estate Board recently published its market report for December 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

The Toronto Regional Real Estate Board recently published its market report for November 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

The Toronto Regional Real Estate Board recently published its market report for October 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

Condo developers have cancelled the Cloverdale Mall project ‘The Clove’.

Pre-sales amounted to less then 10 per cent of total number of units.

Mattamy Homes and QuadReal Property Group confirmed the cancellation largely due to economic uncertainty along with rising construction costs.

The project was designed to transform Cloverdale Mall into a mixed-use community with housing, retail and open public spaces. The decision to cancel the first phase underscores the broader slowdown affecting Toronto’s once booming condo sector.

The Toronto Regional Real Estate Board recently published its market report for September 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

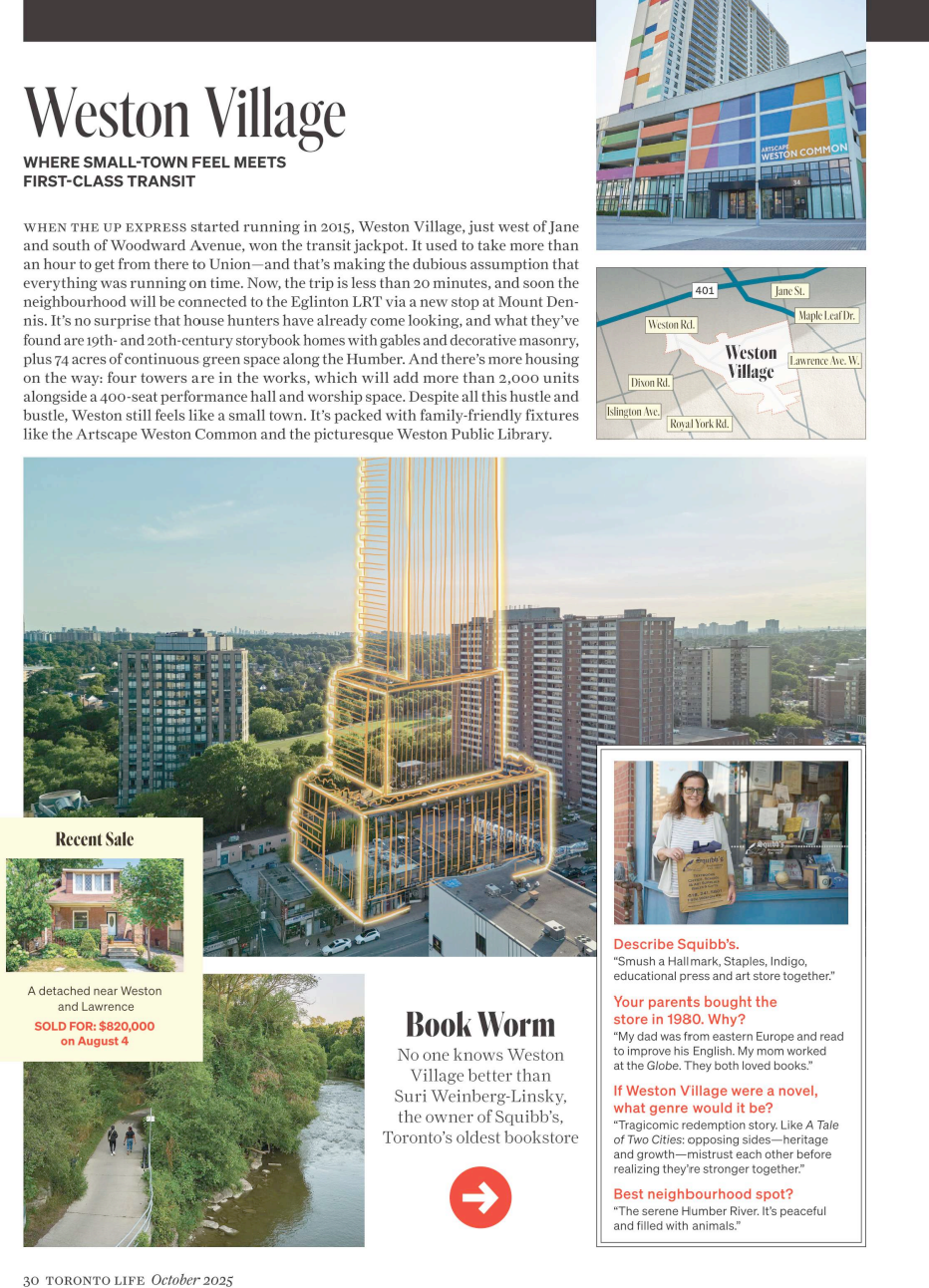

The leaves are changing and so are some Toronto neighbourhoods – destined for big things. We currently have a listing in Weston Village along the shores of the Humber River, a community that blends rich history with exciting new growth. Established in the late 1700s, Weston has long been known for its charming village-style homes, leafy streets, and welcoming character. Today, it offers the best of both worlds: small-town charm with big-city convenience.

With its own GO Station and direct access to the UP Express, Weston residents can be at Union Station in under 20 minutes or at Pearson International Airport in just 15 minutes – a rare level of connectivity in the city. Highway 401 and 400 are minutes away, making travel in any direction simple and stress-free. For those who love the outdoors, the Humber River trails, nearby golf courses, and expansive green spaces provide a natural escape right at your doorstep.

Looking ahead, the banks of the Humber are set to see significant new residential and mixed-use development, bringing even more vibrancy to the area while preserving its historic character. With thoughtful revitalization already underway, Weston is poised to become one of Toronto’s most desirable places to live, offering both lifestyle and long-term value.

Our listing at 10 Wilby Crescent, Unit 1603 captures the very best of what Weston Village has to offer. With stunning views over the Humber River, fall is a particularly gorgeous time to call this home. Offering approximately 1,021 sq. ft. of modern living space, the suite features 3 bedrooms, 2 bathrooms, ample storage with custom closet built-ins, 1 parking spot, 1 locker, and sunny south-west exposures that flood the home with natural light. Amenities include a fitness centre, party room, BBQ area, rooftop lounge with outdoor terrace, bike storage and visitor parking. Move in this fall and enjoy the views!

Read The Full Toronto Life Story About Where to Buy Next

SOURCE: Toronto Life | October 2025

The Toronto Regional Real Estate Board recently published its market report for July 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

Canada's housing markets in Toronto, Calgary, and Vancouver are going through their biggest slowdown in over 10 years. After years of crazy growth followed by a sharp cooldown, buyers, sellers, and curious homeowner want to know one thing: when will things get better?

Here's what the 2025 data tells us: Canada's housing recovery will be slow and different in each city. Calgary will bounce back first, while Toronto and Vancouver will take longer. Three things need to happen for markets to improve: interest rates need to stay low, trade problems with the US need to be fixed, and we need the right balance of homes for sale.

To understand today's market, we need to look at what caused this mess. Four main things happened at once to cool down the market:

The Bank of Canada raised interest rates from almost 0% to 5% between March 2022 and July 2023. This made buying homes much more expensive. About 85% of people renewing their mortgages in 2025 got their original loans when rates were 1% or lower, so they're facing huge payment increases. Even though rates have come down to 2.75%, many people still can't afford to buy.

The government put in several new rules that reduced demand. They banned foreign buyers (extended to 2027), added big taxes for non-residents, and cut immigration targets from 500,000 to 395,000 new people per year. These policy changes removed many buyers from the market.

Tariffs of 10-12% on Canadian exports have hurt the economy. Unemployment hit 6.9%—the highest since 2012. When people worry about losing their jobs, they don't buy houses. This uncertainty made potential buyers wait and see what happens.

Toronto has way too many condos for sale. There are 58 months worth of condos available—14 times more than in 2022. Over 2,800 condo projects were cancelled in 2024, but new ones keep getting built. Vancouver has similar problems with too much rental housing being built.

The numbers show just how much things have changed. These aren't small shifts—the entire market has flipped:

Toronto's market now heavily favours buyers. There are more homes for sale than we've seen in over 10 years, and homes sit on the market for 42 days instead of just 30 days like last year. Only 31% of new listings sell quickly.

What's happening in Toronto (2025):

Average home price: $1.1 million (down 5.4% from last year)

Homes for sale: 27,386 properties (most since 1996)

Time to sell: 42 days (vs. 30 in 2024)

Quick sales: Only 31% of listings

Vancouver has over 17,000 homes for sale, but very few people are buying. June 2025 had the lowest sales in 25 years, showing that buyers are really hesitant even though homes are more affordable.

What's happening in Vancouver (2025):

Average home price: $1.17 million (down 2.8% from last year)

Homes for sale: 17,094 properties (up 25.7% from last year)

Sales: 25.8% below normal levels

Expensive homes ($4M+): 51% fewer sales than last year

Source: CREA Vancouver Statistics

Calgary is different. While sales dropped 17% in May 2025, they're still 11% higher than normal, showing the market has strength. The city is moving from too few homes for sale to a more balanced market.

What's happening in Calgary (2025):

Average home price: $586,200 (down 3% but some areas up 3.7%)

Months of supply: 3+ months (used to be under 1 month)

Sales: 11% above normal levels

Population: Still growing as people move from Toronto and Vancouver

Source: Calgary Real Estate Board

People's attitudes about buying homes have changed a lot. CMHC's 2025 survey of over 4,000 Canadians found that 79-82% of people still think buying a home is a good long-term investment. But most are worried about timing their purchase right.

On social media, the frustration is real. Reddit's r/canadahousing community has over 13,800 members who organize funny but pointed billboard campaigns with messages like "Can't Afford a Home? Have You Tried Finding Richer Parents?" This shows how fed up people are with high prices, even though conditions favor buyers right now.

Real estate experts notice that today's buyers are much smarter than before. About two-thirds make budgets before looking, and 70% keep money aside for unexpected costs. This is very different from the panic buying we saw in previous years.

Three big things need to happen before Canada's housing markets get better:

Rates need to get to 2.25-2.75% and stay there. TD Economics research shows that "real estate responds faster to borrowing cost changes than almost anything else." But trade problems with the US make it hard for the Bank of Canada to cut rates more.

Royal LePage's Phil Soper says that "when the Bank of Canada reaches neutral rates—not slowing or speeding up the economy—investor confidence will jump." Most experts think this will happen by late 2025 or early 2026.

Right now, mortgage rates are 4.84-5.64% for 5-year fixed mortgages. That's down from peaks above 7% but still much higher than the near-zero rates that made buying easy before.

The trade war with America needs to end so businesses and people feel confident again. Tariffs of 10-12% have hurt Canada's economy badly, with TD Economics saying the economy will keep shrinking through mid-2025.

CMHC has three different predictions for housing recovery, all based on what happens with tariffs. Solving trade tensions is the difference between a small recovery and continued problems. People won't buy homes if they're worried about losing their jobs.

We need to fix the imbalance between cities with too many condos (Toronto/Vancouver) and places that need more affordable homes. CMHC says that "home construction will slow down" because investors are pulling back, but it should stay "above normal levels."

The rental market might help. As new rental buildings open, rental prices could drop, making it easier for renters to eventually buy homes. Calgary and Edmonton have been building the most homes in Canada, showing how cities can respond when they make it easier to build.

People moving between cities also matters. While fewer immigrants are coming to Canada, Calgary keeps attracting people from Toronto and Vancouver who want more affordable homes. This helps Calgary's market even as other cities slow down.

Different cities will bounce back at different speeds based on their unique situations. Keep in mind, this is just a prediction based on current data.

Calgary will likely recover first, and experts at PwC and CMHC call it a "top market to watch." Calgary has several advantages:

Strong job market in energy and tech

Much cheaper homes than Toronto/Vancouver

People keep moving there from expensive cities

Home prices still up 3.7% this year to $646,147 despite the slowdown

Calgary's market is moving from too few homes to a balanced market with 2.6 months of supply (up from under 1 month). This shows the market is getting healthier, not crashing.

Toronto faces bigger challenges that will take longer to fix:

Way too many condos: 58 months worth vs. only 4 months in 2022

Homes cost too much for most people

More homes for sale than in almost 30 years

RBC's Robert Hogue warns that "Toronto condo prices could drop more because there are so many for sale." Recovery depends on selling all these extra condos, which could take until 2027.

Vancouver sits somewhere in the middle:

Fewer new homes being built than Toronto helps stability

But homes still cost too much for most buyers

BC's economy depends on trade, which is uncertain right now

June 2025 had the lowest sales in 25 years

Luxury homes ($4M+) saw 51% fewer sales than last year, showing expensive properties are really struggling.

CREA forecasts show:

2025: 469,503 home sales across Canada (down 3% from 2024)

2026: 499,081 sales (up 6.3% - recovery begins)

2027: Back to more normal market activity

CREA's economist Shaun Cathcart sums it up: "We went from expecting a strong rebound to basically treading water" because of trade uncertainty.

Smart investors are finding chances to make money even in this slow market. PwC's 2025 report says "foreign investors with money will start buying Canadian real estate again, taking advantage of cheap prices."

Good investment options include:

Data centers and cold storage buildings as alternatives to regular real estate

Rental apartment buildings because more are being built

Canadian REITs expected to make 20-25% returns in 2025 after losing money for three years

Struggling development projects that well-funded investors can buy cheap

Industry experts say that construction companies are having a hard time, especially smaller ones without much money. This creates chances to buy projects cheap, but also means some new homes might not get built on time.

If you're buying: This is the best time to buy in over 10 years, especially in Toronto and Vancouver. But timing still matters. Focus on good homes in strong neighborhoods and avoid buying just to speculate on price increases.

If you're selling: You need to price your home realistically and make it look great. Experts suggest that sellers should expect homes to sit on the market longer and be ready to negotiate on price.

If you're investing: There are good opportunities, but you need to be careful about which markets and types of properties you choose. Calgary offers the best mix of growth potential and lower risk, while Toronto and Vancouver might pay off more in the long run if you can wait.

Canada's housing markets are changing from the crazy speculation of recent years to more normal, steady activity. Recovery will take until 2027, with Calgary bouncing back first and Toronto/Vancouver following 12-18 months behind.

Here's what needs to happen:

Interest rates stay low around 2.25-2.75%

Trade problems with the US get fixed so people feel confident about their jobs

Cities get the right balance of homes for sale vs. demand

While things are uncertain right now, these conditions also create the best buying opportunities in years for people with steady jobs and good down payments. As mortgage experts say, "it's not a bad time to look for a home" in the right markets if you qualify.

The next 18 months will show whether Canada gets the gradual recovery experts expect or faces more problems. Cities that fix their biggest challenges first—especially Calgary, will lead Canada's housing recovery into 2026 and beyond.

Source: DEEDED.ca “Real Estate Trends” July 21, 2025

The Toronto Regional Real Estate Board recently published its market report for June 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

The Toronto Regional Real Estate Board recently published its market report for May 2025 statistics. Let's take a closer look at some of the key metrics and our expert takeaways you need to know about:

Title: What Happens When a Home Sits Too Long?

If your home has been sitting on the market longer than expected with little interest or activity, you’re not alone — and you’re not out of options. One of the most common reasons a home doesn’t sell quickly? Pricing.

In Today’s Market, Price Matters More Than Ever

Buyers today are savvy. With access to market data at their fingertips, they’re keeping a close eye on value. When a listing lingers without much movement, it naturally raises a red flag. People start to wonder: What’s wrong with the home? Why hasn’t it sold?

Even if your property checks all the boxes — great condition, desirable neighborhood, beautiful photos — an overpriced home can cause buyers to scroll right past it.

The Power of a Strategic Price Adjustment

Here’s the good news: a smart price correction can breathe new life into your listing. It signals to buyers that you’re serious and realistic, and it often attracts a fresh wave of interest — especially from buyers who may have overlooked it the first time.

In many cases, even a modest price reduction can reset the clock on your listing, bringing renewed attention and showing up in search alerts again.

Ready to Rethink Your Strategy? Real estate isn’t one-size-fits-all, and the right pricing strategy depends on your home, your timeline, and your local market. If you’re thinking about your next move or wondering whether it’s time to adjust your list price, let’s chat. Together, we’ll come up with a game plan to get you back on track — and one step closer to that sold sign.

The Canada Greener Homes Loan provides interest-free financing to help homeowners make their homes more energy-efficient and comfortable. It covers eligible retrofits that are recommended by an energy advisor and have not yet been started.

What the Loan Covers:

Energy-efficient windows and doors

Upgraded insulation

Improved heating systems

Solar panels

Other retrofits recommended in your pre-retrofit evaluation

Loan Details:

Amount: $5,000 - $40,000

Repayment Term: 10 years, interest-free

Check out all the details at https://natural-resources.canada.ca/energy-efficiency/home-energy-efficiency/canada-greener-homes-initiative/canada-greener-homes-loan

©Copyright 2023 GTA Selling Real Estate. All rights reserved. | Privacy Policy | Powered by myRealPage