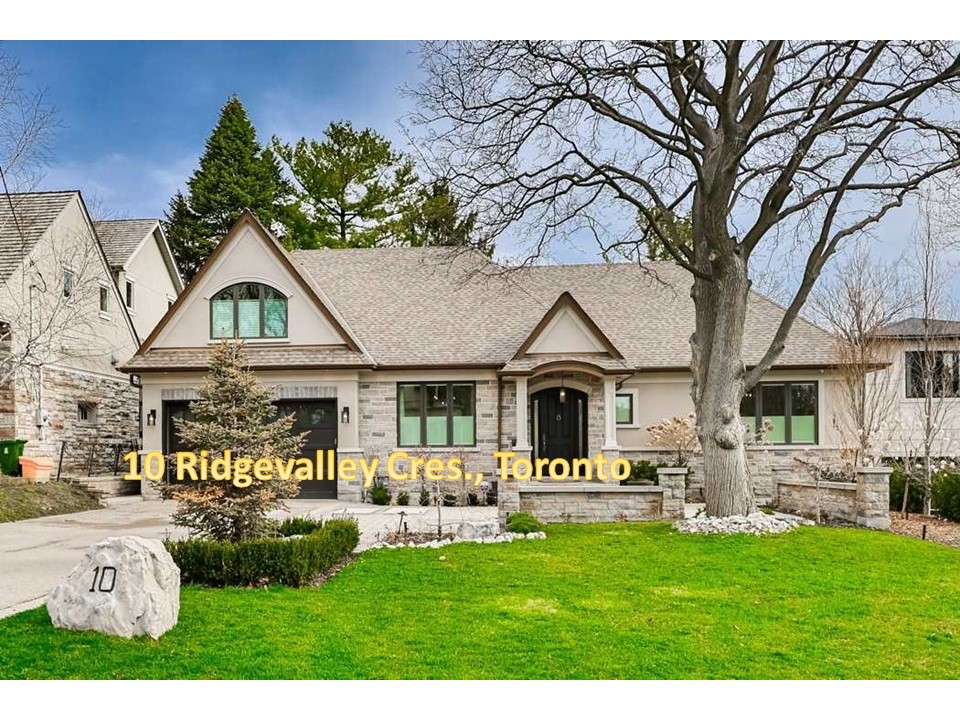

There's a lot to love about this sprawling bungalow that backs onto a premier golf course! Have a look inside...

There's a lot to love about this sprawling bungalow that backs onto a premier golf course! Have a look inside...

Overview of Greater Toronto Area housing market activity during March 2022.

A municipality and administrative district within the city of Toronto, Etobicoke is a diverse and rapidly developing area that attracts new residents from all over the country. With a population of about 365,000 and a variety of different neighborhoods to choose from, the Etobicoke real estate market has seen a surge in high-rise condominiums and other multi-story developments. If you are looking for the best places to live in Toronto, these are some reasons Etobicoke should be on your radar.

Overview of Greater Toronto Area housing market activity during February 2022.

You can't go wrong when buying Mississauga real estate because this city is the perfect balance of city life and suburbia. Mississauga is becoming a popular location for home buyers thanks to its easy waterfront access to the beautiful Lake Ontario, plenty of green space for recreational activities, and proximity to Toronto. Investing in a home in this beautiful Canadian city is a choice you won't regret.

Look at what just listed in our hood! This luxury listing is just steps away from mine on the 14th floor of The James Club. We love this location. steps from Humbertown Plaza where you will find shops, Shoppers, Loblaws, banks, Vanderfleet's Florist, Laura Secord, Baskin Robbins & LCBO! Stroll to The Kingsway shops, Bruno Plaza (Living Lighting, Magoo's Burgers, Party City, Mastermind) bistros and the TTC. Enjoy this rarely offered unit boasting nearly 2800 sq ft of living space, two sided glass fireplace, 2 generous bedrooms, 3 baths, formal dining area, large family room & and city Skyline views! Hit the gym, swim in the pool, get together with friends for a film in the movie room, enjoy agame of pool or party in the party & room. Stroll along the scenic Humber River or picnic in iconic James Gardens

Overview of Greater Toronto Area housing market activity during January 2022.

Buying a home can be equally stressful and exciting, but it is always a venture that is worth undertaking. When looking into Toronto homes for sale, consider everything that would create an environment for you and your family to thrive. No detail is too small when you're looking for your forever home.

Overview of Greater Toronto Area housing market activity during 2021.

"We love this 2200 sq ft penthouse with a rare 2000 sq ft terrace boasting 270 degree views!!

Enjoy the perks of Bloor West Village shops and picturesque Old Mill.

"We love this penthouse - boasting generous, modern living space, 4 bedrooms and incredible views"

"Close to off leash dog park and tennis!"

Finding and purchasing a home can seem like daunting challenge, especially to inexperienced first-time home-buyers. However, with the right knowledge and assistance on your side, you can find the best Toronto home prices and the house of your dreams. Follow these tips when you're starting your search.

©Copyright 2023 GTA Selling Real Estate. All rights reserved. | Privacy Policy | Powered by myRealPage